Experienced Fractional CFO Services

Build a winning strategy and make better decisions with strategic financial leadership.

G-Squared Partners has a rating of 4.9 Stars with reviews from 50+ clients.

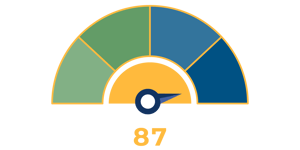

In our 2025 Client Survey, we achieved a NPS of 87: significantly higher than the accounting industry average of 39.

Nearly 9 out of 10 clients would recommend us to a friend or colleague.

Strategic Financial Leadership for Growing Businesses

G-Squared Partners provides fractional CFO services to companies spanning a diverse range of industries. We understand that small-to-mid-sized businesses, startups, and growth-stage companies need strategic financial guidance but lack the resources for a full-time CFO.

Our seasoned team delivers the expertise you need to drive your business forward at a fraction of the cost. Whether you're refining financial strategies, enhancing operational efficiency, or securing funding, we offer flexible, scalable solutions tailored to your unique needs. Partner with us to unlock your company's full potential through expert financial guidance and strategic insight.

What to Expect From Our Fractional CFO Services

Cash Flow Forecasting & Management

Stay ahead of your cash position with clear, reliable forecasts. We help you anticipate funding needs, manage burn, and make confident decisions about hiring, investment, and growth.

New Debt Financing

Secure the right capital for your next stage of growth. We help you evaluate lending options, prepare financial packages, and negotiate terms that align with your company’s long-term goals.

Bank Packages

Present your business with confidence. We prepare complete, professional bank packages that highlight your company’s financial strength and make it easier to secure financing or renew existing credit lines.

Due Diligence

Be ready for every question investors or buyers will ask. We provide thorough financial due diligence support, uncovering risks and validating performance so your business inspires confidence and maximizes value.

Obtaining 409 A Valuations

Compliant, defensible valuations for your growing business. We coordinate 409A valuations that meet IRS standards, support equity compensation planning, and withstand investor and auditor scrutiny.

Board Presentations & Reporting

Keep your board informed and engaged with accurate, well-structured reports. We prepare polished financial packages and participate in meetings to provide insights, context, and clarity.

Equity Fundraising Support

Raise capital with confidence and credibility. We help you prepare financial models, data rooms, and investor-ready materials that clearly communicate your company’s value and growth potential.

Process Analysis & Improvement

Transform your financial operations from reactive to efficient. We assess your accounting and reporting workflows, identify bottlenecks, and implement streamlined processes that scale with your business.

Budgeting and Forecasting

Plan with precision and adapt with confidence. We help you build realistic budgets and rolling forecasts that align spending with strategy and keep your business on track for growth.

Financial Statement Preparation

Accurate, audit-ready financials you can trust. We prepare clear, GAAP-compliant statements that give stakeholders, investors, and lenders full confidence in your company’s performance.

Cap Table Maintenance

Stay organized as you grow and raise capital. We manage and reconcile your cap table to ensure accuracy across funding rounds, option grants, and equity transactions—so you’re always investor-ready.

Performance Measurement & Reporting

Identify, measure, and act on the numbers that matter most. We help you define key financial and operational metrics, then create dashboards and reports that keep your team aligned and accountable.

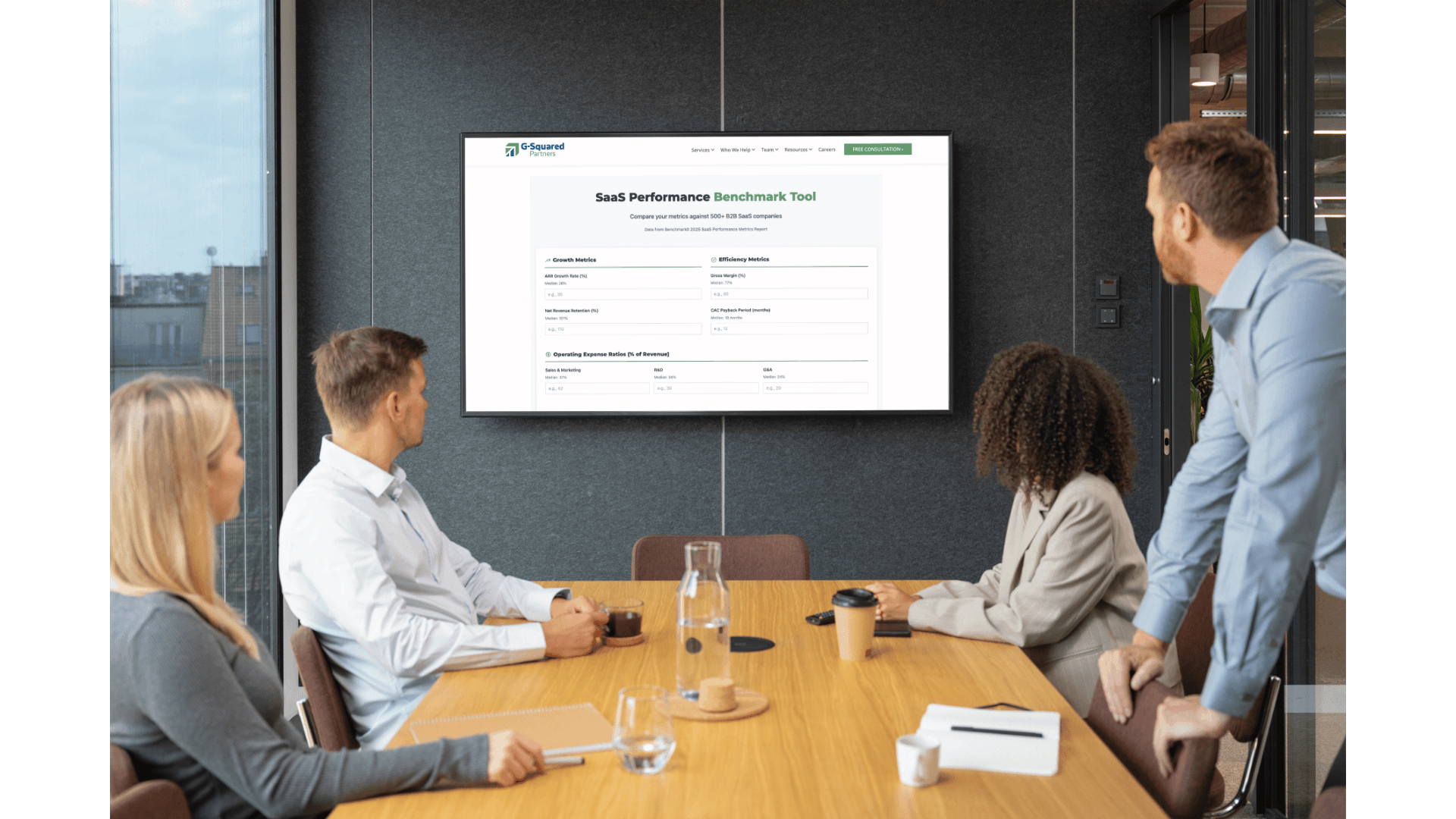

SaaS Benchmark Tool: Compare Your Metrics to 500+ Industry Peers

Compare your growth, margins, and efficiency to hundreds of other SaaS companies — in minutes. Enter your key metrics to instantly see how your performance measures up against your peers. Identify strengths, spot opportunities, and get a clear picture of how efficiently your business is scaling.

Why Work With a Fractional CFO?

Reduce Costs

Access the experienced financial leadership a CFO brings at a fraction of the cost of hiring a full-time executive.

Realize Efficiencies

Our services scale up or down with the needs of your business, leaving you free to focus on what you do best.

Improve Processes

Build the financial infrastructure and processes required to handle sustained growth at scale.

Proven Expertise

Our team brings a track record of success, with experience in every element of financial leadership.

Gain Peace of Mind

What you need, when you need it. Outsourced CFOs provide the insights and assurance needed to lead.

Confidence to Scale

Get guidance from experienced financial leaders who know how to navigate common growth challenges.

A "Go-To Firm for Outsourced CFO Services"

G-Squared Partners is our go-to firm for part-time CFO services. They provide value beyond the classic CFO responsibilities, including participating in strategy sessions, obtaining financing, identifying KPIs and getting significant transactions completed.

Osage Venture Partners

A "True Partner and Extension to our Team"

G-Squared is more than the outsourced financial services they provide to our organization. They continually work with us to align our strategic vision with the goals of the organization via deep industry expertise; a strong understanding of where markets are trending; and multifaceted experience in diverse industries. On more than one occasion, their forward-leaning guidance, as market conditions evolve, has avoided the pitfalls that have befallen our competitors. Partnership and results-driven outcomes are the cornerstones of our track record together.

David Stefanich, Founder/CEO

The only Firm to meet the Needs of Our Fast-Growing SaaS Company

After having tried multiple other service providers and platforms, G-Squared is the only firm that brings together the right combination of CFO, Accounting, and Bookkeeping services in a way that integrates naturally with my team and meets the needs of a fast-growing SaaS Company.

DataKwip, Inc.

They're a Member of Our Team

G Squared Partners has served as our CFO and accounting team for over 4 years. While the skill set and the professionals involved with our company have always been outstanding, what really stands out to me is their commitment to the company’s success. We don’t look at them as an outsourced service provider but as an integral member of the team. Just like we expect from any of our employees, they consistently do whatever it takes to complete a project on time regardless of the time pressures. When working with outside investors, due diligence exercises as well as general day-to-day managing the business, their efforts are a critical component of our success.

Powerlytics, Inc.

A Partner with Nationwide Reach

G-Squared Partners is equipped to support your business's financial needs, wherever you're based.

From Silicon Valley to New York City, our outsourced financial experts are here to help.

Schedule a Free 30 Minute Strategy Session

What to Expect:

A high-level financial assessment of your business.

Guidance on key financial challenges like cash flow, profitability, or scaling.

Insights on how our Fractional CFO solutions can help you reach your goals.

-3.jpg?width=400&name=G-Squared%20Blog%20Image%20(11)-3.jpg)

-png.png?width=400&name=woman%20presenting%20in%20front%20of%20screen%20with%20graphs%20(1)-png.png)