Accounting for Tech Startups

Get strategic financial leadership, reliable execution, and investor-grade rigor — without hiring a full finance team.

Founders build great products. We build financial confidence.

At G-Squared Partners, we partner with high-growth tech companies to deliver accounting, CFO, and financial advisory services tuned to the complexities of scaling technology businesses.

Whether you're closing your Series A, managing product launches across regions, or preparing for M&A, we help you navigate every financial inflection point.

4.9 Stars

Average Client Rating

On independent review site ClearlyRated, G-Squared Partners has a rating of 4.9 Stars with reviews from 50+ clients.

87

Net Promoter Score

In our 2025 Client Survey, we achieved a NPS of 87: significantly higher than the accounting industry average of 39.

9 out of 10

Would Recommend G-Squared Partners

Nearly 9 out of 10 clients would recommend us to a friend or colleague.

A Holistic Approach to Tech Startup Accounting

Fractional Tech Startup CFO

Strategic financial leadership for founders ready to scale. Our experienced CFOs help you manage cash flow, model growth scenarios, and prepare for fundraising or exit—without the full-time cost.

Learn MoreOutsourced Accounting & Bookkeeping

Accurate, investor-ready financials from a team that understands tech. We manage your month-end close, revenue recognition, and reporting so you can focus on building your product—not your spreadsheets.

Learn MoreTurnaround Management

When growth stalls or cash runs tight, we step in to restore control. Our team stabilizes operations, rebuilds financial discipline, and charts a path back to sustainable performance.

Learn MoreFundraising Support

Raise capital with confidence. We help tech founders build investor-ready financial models, prepare data rooms, and present metrics that stand up to due diligence and accelerate deal momentum.

Financial Modeling & Forecasts

Turn your vision into numbers investors can trust. We build dynamic financial models and forecasts that clarify your runway, guide strategic decisions, and support smarter growth planning.

Board Reporting & Meeting Prep

We make sure your portfolio companies walk into every board meeting fully prepared. Our reporting packages deliver clear, accurate financials and actionable insights, giving directors confidence in the numbers and the ability to focus on strategy instead of cleanup.

M&A Support

Navigate transactions with clarity and confidence. From financial due diligence to valuation modeling and post-deal integration, we help founders maximize deal value and minimize disruption.

Financial Statement Preparation

Investor-grade financials, delivered with precision. We prepare clear, GAAP-compliant statements that withstand scrutiny from auditors, investors, and potential acquirers.

Startup Metrics & KPI Tracking

We identify the metrics that truly matter for your stage of growth—then build dashboards that give you real-time visibility into performance, burn, and progress toward investor goals.

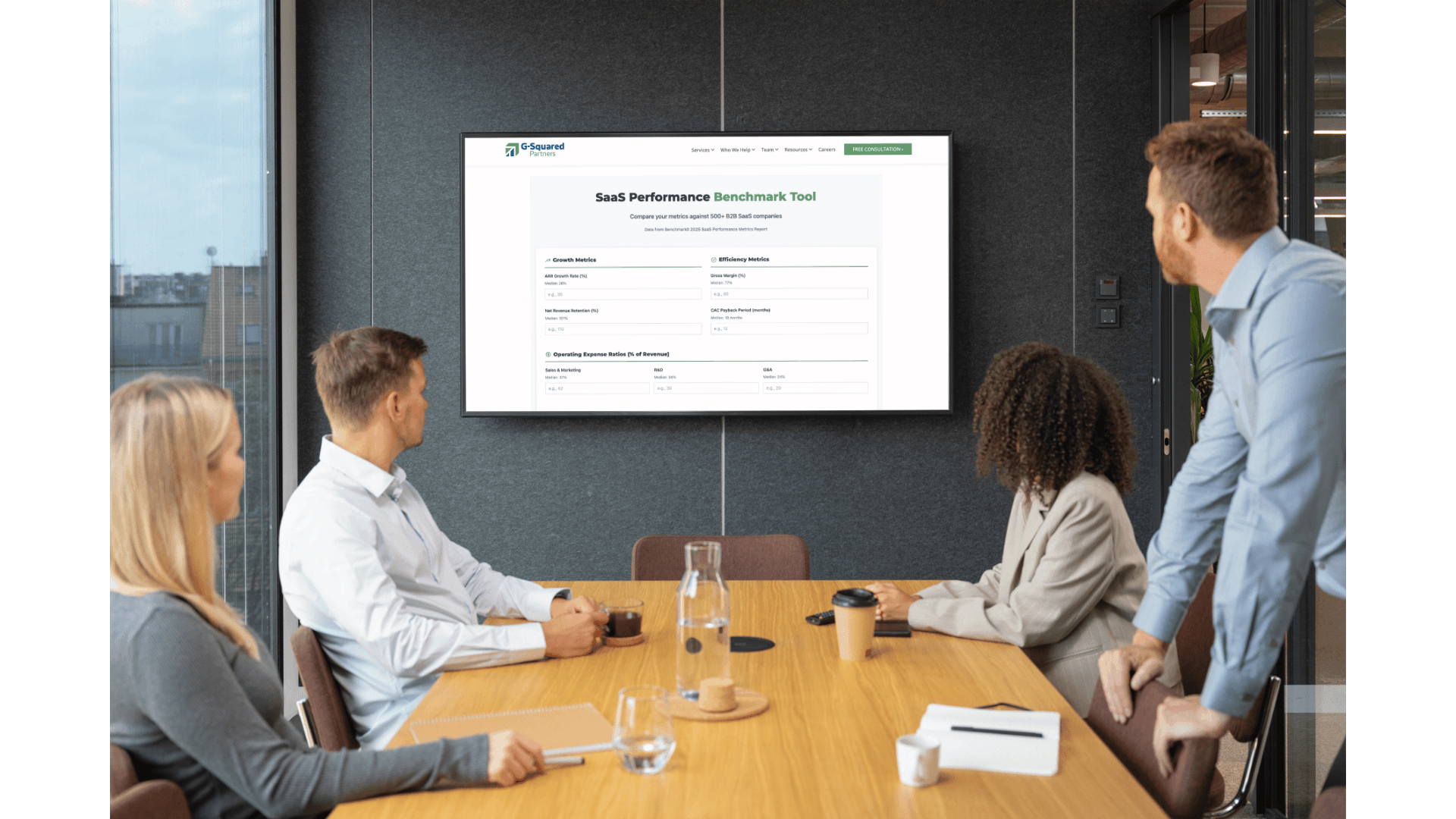

SaaS Benchmark Tool: Compare Your Metrics to 500+ Industry Peers

Compare your growth, margins, and efficiency to hundreds of other SaaS companies — in minutes. Enter your key metrics to instantly see how your performance measures up against your peers. Identify strengths, spot opportunities, and get a clear picture of how efficiently your business is scaling.

G-Squared Partners' Tech Startup Accounting Experience

SaaS (Software as a Service)

G-Squared Partners has extensive experience with SaaS companies, which often face unique financial models based on recurring revenue, customer acquisition costs, and long-term customer value. We have helped these companies with cash flow management, forecasting, and strategies for scaling while maintaining a sustainable subscription model.

Biotech

Biotech startups, known for their long product development cycles and heavy R&D investments, require a nuanced approach to financial planning and fundraising. G-Squared has worked with biotech companies and life science firms, assisting them in managing their complex funding requirements, navigating regulatory landscapes, and planning for high research and development costs.

Fintech

In the rapidly evolving fintech sector, G-Squared has provided financial expertise to startups dealing with digital payments, personal finance, and blockchain technologies. Their role often involves strategic planning for rapid growth, compliance with financial regulations, and navigating the competitive landscape of financial technology.

Hardware

Hardware startups, with their manufacturing, inventory, and supply chain complexities, present unique financial challenges. G-Squared has helped these companies with cost analysis, inventory management, and strategies for scaling production while managing the financial risks associated with physical product development.

Our diverse experience across various tech sectors makes us a valuable partner for tech startups looking for knowledgeable and adaptable financial guidance.

Unlock the Metrics That Matter

Investors don’t just want a great idea—they expect you to know your numbers. Our free guide, “Financial Metrics for Tech Companies,” walks you through the key metrics every startup needs to track, from ARR and CAC to retention and runway. You’ll learn how to structure your reporting, interpret what the numbers mean, and use them to make smarter growth decisions.

Whether you’re raising your first round or scaling to the next stage, this guide will help you build the financial clarity and discipline tech investors demand.

A "Go-To Firm for Outsourced CFO Services"

“G-Squared Partners is our go-to firm for part-time CFO services. They provide value beyond the classic CFO responsibilities, including participating in strategy sessions, obtaining financing, identifying KPIs and getting significant transactions completed.”

Osage Venture Partners

Super Capable and Great to Work With

"Gene and the team are super capable and great to work with. It has been an exceptional help to our business."

Matt Ranauro - Benefix

G-Squared Partners Understand the Needs of a Rapidly Growing Business

G-Squared Partners understands the needs of a rapidly growing business. Their ability to combine depth of experience with proactive guidance and execution of financial operations is second to none.

Cory Perdue - DataKwip

Always Responsive and Do Whatever It Takes

They take a true interest in the business, working as if it was their own business. Always responsive and they do whatever it takes to get the job done within the time frame that is needed.

Kevin Sheetz - Powerlytics

FAQs

Have questions about how we support tech startups? We’ve answered some of the most common ones below. If you don’t see what you’re looking for, reach out anytime. We’re always happy to connect and learn more about your business.

-1.jpg?width=400&name=Copy%20of%20Sample%20Blog%20Image%20w%20Gradiant%20(8)-1.jpg)

-1.jpg?width=400&name=Copy%20of%20Sample%20Blog%20Image%20w%20Gradiant%20(7)-1.jpg)