Outsourced Accounting Services for SaaS Companies

Empower your SaaS company by working with G-Squared Partners’ team of expert SaaS accountants.

4.9 Stars

Average Client Rating

On independent review site ClearlyRated, G-Squared Partners has a rating of 4.9 Stars with reviews from 50+ clients.

87

Net Promoter Score

In our 2025 Client Survey, we achieved a NPS of 87: significantly higher than the accounting industry average of 39.

9 out of 10

Would Recommend G-Squared Partners

Nearly 9 out of 10 clients would recommend us to a friend or colleague.

An Expert Approach to SaaS Accounting

Fractional SaaS CFO Services

Strategic financial leadership without the full-time cost. Our SaaS CFOs have served in leadership roles at established businesses and bring expertise to optimize operations, improve cash flow, and drive profitable growth.

Learn MoreOutsourced SaaS Accounting & Bookkeeping

Ensure accurate financial records with specialized SaaS accounting expertise. We handle everything from the month-end close to customer billing and collections, preparing financial statements, and more.

Learn MoreExit Planning Consulting

Maximize the value of your SaaS business with comprehensive exit strategy development. We help optimize operations, strengthen financials, and structure your company to attract premium valuations when you're ready to transition.

Learn MoreProfit Improvement & Turnaround Management Services

Transform underperforming operations into profitable business units with data-driven analysis and targeted interventions. We identify margin issues, identify operational improvements, and help you access credit and financing solutions.

Learn MoreAudit Preparation Services

Navigate complex audit requirements with confidence and minimal disruption. We prepare your financial records, documentation, and team to meet audit standards efficiently.

Learn MoreAccounting Department Assessments

Optimize your financial operations with a comprehensive review of your accounting structure, processes, and systems. We deliver practical recommendations to enhance accuracy, efficiency, and strategic insight.

Learn MoreA "Go-To Firm for Outsourced CFO Services"

“G-Squared Partners is our go-to firm for part-time CFO services. They provide value beyond the classic CFO responsibilities, including participating in strategy sessions, obtaining financing, identifying KPIs and getting significant transactions completed.”

Osage Venture Partners

Super Capable and Great to Work With

"Gene and the team are super capable and great to work with. It has been an exceptional help to our business."

Matt Ranauro - Benefix

G-Squared Partners Understand the Needs of a Rapidly Growing Business

G-Squared Partners understands the needs of a rapidly growing business. Their ability to combine depth of experience with proactive guidance and execution of financial operations is second to none.

Cory Perdue - DataKwip

Always Responsive and Do Whatever It Takes

They take a true interest in the business, working as if it was their own business. Always responsive and they do whatever it takes to get the job done within the time frame that is needed.

Kevin Sheetz - Powerlytics

Get Our Ultimate Guide to SaaS Business Accounting

At G-Squared Partners, we’ve provided SaaS accounting services to over 100 SaaS businesses.

Our team has years of experience leading publicly traded SaaS companies and have the skills required to upgrade your financial systems, help you raise investment rounds, and more.

Our Ultimate Guide to SaaS Business Accounting covers all the basic concepts founders and executives need to know to build a solid financial footing equipped to handle scale.

We can help your firm achieve its financial goals.

Tailored Financial Solutions

Recognizing that no two SaaS companies are the same, we offer customized financial solutions that align with your specific business objectives. Whether you're a startup seeking to establish a solid financial foundation or a growth-stage company looking to scale, our services are designed to meet you where you are.

-1.jpg?width=400&name=Copy%20of%20Sample%20Blog%20Image%20w%20Gradiant%20(1)-1.jpg)

Specialized SaaS Expertise

We deeply understand the SaaS business model and its unique challenges and opportunities. Our team is well-versed in the nuances of SaaS accounting, from revenue recognition to customer acquisition costs and lifetime value analysis, ensuring your financial strategies are both compliant and optimized for growth, especially if you are expecting to raise venture capital or are planning an exit via private equity.

-2.jpg?width=400&name=Copy%20of%20Sample%20Blog%20Image%20w%20Gradiant%20(2)-2.jpg)

Strategic Growth Support

Beyond traditional accounting services, G-Squared Partners acts as a strategic advisor to your SaaS company. We provide valuable insights into financial performance, help identify areas for improvement, and offer guidance on strategic decisions that can propel your business forward.

-2.jpg?width=400&name=GSQ_MAR_%20(2)-2.jpg)

Proactive and Responsive Service

Our team prides itself on being responsive and proactive in addressing our clients' needs. We stay ahead of the curve on accounting standards, ensuring that your company is always prepared for what's next, allowing you to focus on running your business with peace of mind.

-1.jpg?width=400&name=Copy%20of%20Sample%20Blog%20Image%20w%20Gradiant%20(4)-1.jpg)

Transparent Pricing

G-Squared Partners believes in transparency, especially when it comes to pricing. We offer clear, upfront pricing models tailored to the scope of services you need, ensuring there are no surprises and that you receive value that far exceeds the cost.

.jpg?width=400&name=Copy%20of%20Sample%20Blog%20Image%20w%20Gradiant%20(13).jpg)

Long-Term Partnership

Our goal is to build long-term relationships with our clients. We see ourselves as an extension of your team, committed to your success. By understanding your business inside and out, we can provide consistent, high-quality service that grows with your company.

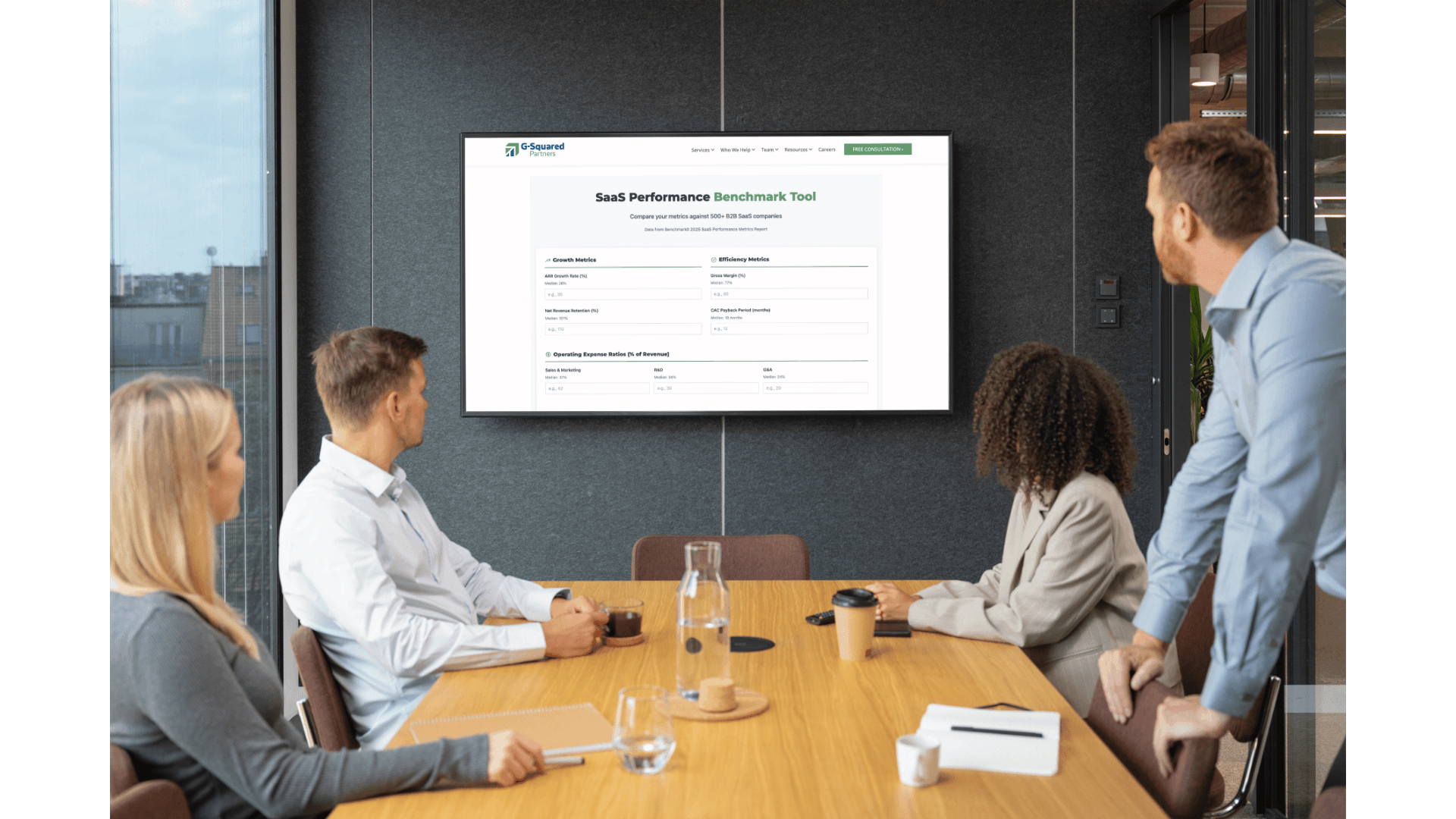

SaaS Benchmark Tool: Compare Your Metrics to 500+ Industry Peers

Compare your growth, margins, and efficiency to hundreds of other SaaS companies — in minutes. Enter your key metrics to instantly see how your performance measures up against your peers. Identify strengths, spot opportunities, and get a clear picture of how efficiently your business is scaling.

Benefits of Outsourced SaaS Accounting Guidance

Outsourcing accounting functions offers a myriad of benefits specifically tailored to the operational dynamics and growth trajectories of SaaS companies. By entrusting financial tasks to the specialized experts at G-Squared Partners, SaaS businesses can leverage several strategic advantages.

Cost Efficiency

Outsourcing eliminates the need for in-house accounting staff, reducing overhead costs associated with salaries, benefits, and training. This model allows for scalable services matching your company's growth, ensuring you pay only for the expertise you need when needed

Access to Specialized Expertise

SaaS accounting is nuanced, with unique challenges such as revenue recognition, subscription models, and customer lifetime value calculations. Outsourced accounting services provide access to professionals who are not just experts in accounting but also specialize in the SaaS sector, ensuring that your financial strategies are aligned with industry best practices.

Enhanced Financial Accuracy and Compliance

With the ever-evolving landscape of financial regulations, maintaining compliance is crucial. Outsourced accountants stay abreast of the latest accounting standards and tax laws, ensuring your financial reporting is accurate, compliant, and timely, thereby reducing the risk of costly errors or legal issues. If issues do arise, you can rest assured that our audit preparation services are some of the best in the industry.

Strategic Financial Insights

Beyond bookkeeping, outsourced SaaS accounting services offer strategic insights into financial performance, helping identify opportunities for cost savings, profit improvement, and investment. This level of analysis supports informed decision-making and can be pivotal in steering the company towards sustainable growth.

Focus on Core Business Functions

One of the most significant benefits is that outsourced accounting services allow your team to focus on core business activities without the distraction of managing day-to-day financial operations. This can lead to improved product development, marketing strategies, and customer service, driving revenue and enhancing customer satisfaction.

Scalability

As your SaaS company grows, your financial needs will evolve. Outsourced accounting services can easily scale up or down to meet your changing requirements, providing flexibility and support through every stage of your business lifecycle.

-3.jpg)

How Much Do SaaS Accounting Services Cost?

Understanding the cost of SaaS accounting services is crucial for companies considering outsourcing their financial management. The pricing can vary widely based on several factors, including the scope of services, the size of your business, and the complexity of your financial needs. Here's a breakdown to help you navigate the cost landscape:

- Scope of Services. The range of services you require will significantly impact the cost. Basic bookkeeping services are less expensive than comprehensive financial management, which includes strategic planning, financial analysis, and specialized SaaS reporting.

- Company Size and Transaction Volume. The size of your business and the volume of transactions can affect pricing. A larger company with more complex transactions may require more time and expertise, leading to higher costs.

- Complexity of Your Business Model. SaaS companies often have unique financial structures, including recurring revenue models, deferred revenue, and customer acquisition costs. The complexity of these models can influence the cost of accounting services, as they require specialized knowledge and tools to manage effectively.

- Customization and Additional Services. Custom reports, financial forecasting, and tax planning are examples of additional services that can add to the cost. The more customized the service, the higher the fee might be.

Ready to Elevate Your SaaS Company's Financial Strategy?

Working with G-Squared Partners offers more than just accounting solutions; it's a strategic move toward financial clarity and business growth. Our dedicated team of SaaS financial experts is ready to tailor a suite of services to your company's unique needs, providing guidance for whatever lies ahead.

Contact us today to discover how we can help transform your financial management and propel your SaaS company to new heights.

Let's Talk Business. Your Business.

Let’s talk about your business and how our services can benefit your company.

Fill out this form and we'll send you information on the service you're interested in.

Interested in working with us?

Use the link in your email to set up a time to meet with us to learn if it's a good fit.

Schedule a Consultation

FAQs

Got a question about our services for SaaS businesses that you didn't see answered on this page? Below, we've listed some of the most common questions we hear from clients, as well as our answers. If you still don't see what you're looking for, contact us now – we're happy to talk.

What are outsourced SaaS accounting services?

Outsourced SaaS accounting services refer to hiring external experts who specialize in managing the unique financial needs of SaaS businesses. These services can include bookkeeping, revenue recognition, cash flow management, financial reporting, calculating KPIs and more, tailored specifically to SaaS companies.

Why do SaaS companies need specialized accounting services?

SaaS businesses operate on a subscription model, which presents unique accounting challenges like revenue recognition, deferred revenue, and customer acquisition costs. Specialized SaaS accountants ensure financial accuracy, compliance, and strategic insights, helping businesses navigate these complexities.

How much do outsourced SaaS accounting services cost?

Pricing for outsourced SaaS accounting services starts at $1,000 per month, but costs vary based on the scope of services, company size, and complexity of the financial model. Customized financial solutions and additional services like cash flow planning or forecasting can also affect the price.

How do outsourced SaaS accounting services help with revenue recognition?

Outsourced SaaS accountants are well-versed in the complexities of revenue recognition under accounting standards. They ensure that your subscription revenues are accurately recorded and compliant, helping avoid costly financial errors and supporting your business’s growth trajectory. They also report the KPIs that investors require.

What services are included in SaaS accounting?

Outsourced SaaS accounting services typically include bookkeeping, revenue recognition, cash flow management, financial reporting, tax preparation, and strategic financial insights. Services are customized based on the needs and growth stage of the SaaS business.

How can outsourcing accounting services help SaaS companies scale?

Outsourced accounting services can scale with your SaaS business as it grows. You pay only for what you need, and the services can expand or contract based on transaction volume and business complexity, offering flexibility without the need for in-house staff.

Is outsourcing SaaS accounting cost-effective?

Yes, outsourcing can be more cost-effective than maintaining an in-house accounting team. It eliminates overhead costs such as salaries and benefits, as well as option grants, while providing access to highly specialized expertise, ensuring your financial management is in expert hands. Prices for these services start at $1,000 per month.

Why do SaaS companies outsource their accounting?

What makes SaaS accounting different from traditional accounting?

What services does G-Squared Partners provide for SaaS companies?

What types of SaaS companies do you typically work with?

What accounting systems and tools do you support?

We’re fluent in all major tools in the modern SaaS finance stack and can also help you select and implement the right systems as you grow.

How does G-Squared Partners support SaaS metrics and reporting?

Will G-Squared Partners handle revenue recognition and ASC 606 compliance?

How do you work with internal teams?

What if our books are messy or behind?

That’s common — and fixable. We frequently help SaaS companies catch up on months or even years of financials, clean up balance sheets, correct revenue schedules, and bring structure to chaotic reporting environments.